By William T. Koldus and Darren McCammon

A Conversation Regarding Energy XXI Gulf Coast (EGC)

The following is a discussion regarding Energy XXI Gulf Coast between Darren McCammon of Cash Flow Kingdom and William Koldus of The Contrarian. We thought it might be useful to show readers the kind of constructive back and forth conversions that sometimes occur behind the paywall. The actual email conversation has been mildly edited to enhance readership for the publication of this article.

William's First Email (May 11th, 2018):

Hi Darren,

Recently, I published a Seeking Alpha public article, titled "Energy XXI Gulf Coast - Extraordinary Return Potential."

Previously, I had covered this in The Contrarian, my premium research service on Seeking Alpha.

In the commentary section of the article, several readers mentioned that you had also covered Energy Gulf Coast for your premium research service, Cash Flow Kingdom. As a previous fan of your work on Archrock (AROC), this intrigued me. I have a few questions.

First, what sparked your interest in Energy Gulf Coast?

Second, what was management of EGC thinking with their ARO transaction?

As CDM Capital noted in the commentary section (of the public article linked above), they moved the annual meeting, so they thought the move would be well received, but it seems overly complicated, and has left investors scratching their heads trying to figure it out. What is your brief take on this recent development?

Darren��s Initial Response:

Hi William,

I read your article, it was very well done. Yes, we've been following Energy XXI Gulf Coast off and on at Cash Flow Kingdom. Sorry this is going to be a bit long and convoluted answer. I'll try to minimize what I can.

I had an investment in CorEnergy (CORR) a while back when it was trading in the low teens. It had done a deal with Energy XXI (symbol EXXI at the time) to buy its pipeline and then lease it back to them. As part of due diligence on the CORR investment, I needed to decide if CORR was going to get paid (answer yes, by whomever owned those wells, EXXI or not), and ultimately, I learned more about Energy XXI.

When EXXI went bankrupt, another member of Seeking Alpha indicated they thought the unsecured EPL 8.25% notes had a very strong negotiation position in the bankruptcy, effectively a decent claim to first position on the EPL properties. Doing my own further research on this suggestion, I concluded that this appeared to be correct (though of course you never know what will happen in court) and the EPL notes were going to have their own lawyer (very important in a bankruptcy) ultimately buying some of those EPL notes at 5垄 on the dollar. We got one more interest payment as the company needed to buy a little more time, bringing the net cost down to 3垄.

Fast forward to near the end of the bankruptcy and the notes are now trading at 18 cents on the dollar (6x). Ultimately those translated into shares plus warrants, and I sold the shares at prices that were 6x - 3x gains, keeping the warrants (which I still own). Other much larger bondholders however couldn't sell without affecting price drastically, a disadvantage for them.

Since then, coverage of EXXI wasn't formal on my part, but a number of members of Cash Flow Kingdom kept up with it, even occasionally buying or selling. The underlying value in the PV10 reserves was there, especially in the (Proven and Possible assets) 2P, but there was (and still is) a whole lot of turmoil and uncertainty between here and there. In particular two CFK members tracked Franklin Resources and other major bankruptcy former bondholders unloading of their shares, trying to figure when would be the best time to get back in. When they indicated in chat, "I think Franklin is done or at least pretty darn close to it" backing it up with data, links and statistics, they pretty much nailed it on the head. Energy XXI Gulf Coast, now symbol EGC, was trading for less than $4 a share while simultaneously having an updated reputable third party 2P valuation a little over $30. I and others on Cash Flow Kingdom started to add. My current average price this time around being $5.30 with an allocation equal to 7.5% of my portfolio.

We know management already was working on this transaction a quarter ago when they hinted about pursuing a deal that involved selling non-core assets and, in the process, getting rid of a lot of ARO obligations. So, you have to put it in context, at the time WTI was trading around $60, and we had no idea whether it would decline back into the $50s (still don't by the way). Management's main problem is a lack of production due to almost no drilling since 2014. Get the production up, and costs fall significantly on a per barrel basis; fixed costs get spread over a larger base (in particular ARO gets better as it not only spreads but likely also gets further delayed), margins and cash flow goes way up, which in turn funds drilling, which increases production..... It��s a virtuous cycle, given the right price, but it has a chicken and egg problem. How do you get it started when you don't have the cash available to do the drilling you need and banks won't lend it to you in part because the Proven (1P) assets they are willing to lend on are so low (due to a lack of drilling)? This deal effectively solves that main problem by both removing a sizeable chunk of the ARO cost issues and priming the lending pump. To be clear, if we were still in the high $50s, low $60s on oil price, I'd think this a great deal.

Thoughts on the complex ARO deal and management moving the annual investor meeting time slot until after this call:

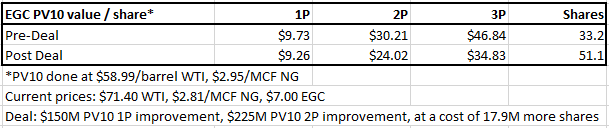

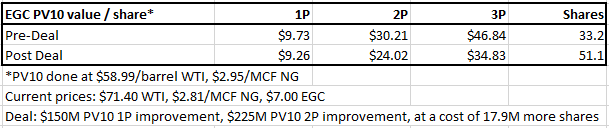

My initial read on the deal is it reduces the upside while also de-risking the downside significantly. Here's my estimate of strip PV-10 before and after the deal:

It is obviously a complex deal, but what you have basically done is traded upside, 2P goes from $30 to $24 per share, in return for de-risking the opportunity. A lot of ARO gets eliminated in return for shares (note both are already factored in to the PV-10 above), and in doing so likely allows them to arrange ongoing financing into 2019. This was clearly a good deal with prices around $60, but questionable with prices over $70 simply because I THINK there is now a better option.

My calculations (again done in conjunction with another CFK member) indicate prices received of $67 or better, combined with existing hedges and cash, should be enough to fund the drilling program. If correct, then they could instead choose to hedge all the existing production possible at LLS $67+ (LLS is the closest to what they actually get for their oil). Currently, factoring in heavy backwardation, that means they could hedge all production out to April 2019. As oil prices continue to rise, or we get closer to that date causing the backwardation to be less of a factor, we could then hopefully add hedges for May 2019, June, July, etc. While this limits our near-term upside, and still carries late 2019 funding risk, it also does not require any dilution.

That being said, my calculations could be wrong, and the existing deal is complex. I have some calls in trying to set up a discussion to better understand the deal, and hope to hear back with a time.

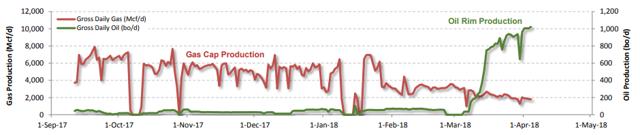

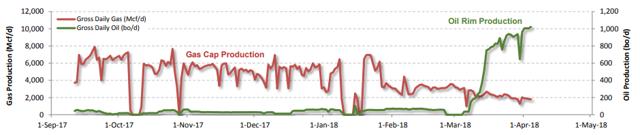

Side note: You didn't ask but I thought I'd point out from an operational point of view the last drill, West Delta 31 High Tide, is doing well. It came in 12% under planned cost and is now running at over planned production; 1,019 bo/d + 1.935 Mcf/d as of the 4/2/2018 well test, with the oil looking like it is continuing to ramp as the initial gas volume declines.

What do you think William? Is the ARO deal a good one? Do we really have the potential to not approve it down the road and if so what optionality does that imply? What about EGC as general investment either with or without the deal?

What do you think William? Is the ARO deal a good one? Do we really have the potential to not approve it down the road and if so what optionality does that imply? What about EGC as general investment either with or without the deal?

William:

Darren,

Thank you for the terrific, detailed response, including the closing comment about drilling results, touching on production, which is perhaps the key point going forward, IMO, for us EGC shareholders.

Elaborating on this further, if EGC could waive a "magic wand" and increase production today, it would be a "home-run" type of investment overnight. What the market is questioning, from my perspective, is their ability to raise financing to fund an enhanced drilling program, and/or their patience to wait for higher oil prices to kick in, to fund the accelerated drilling program, which is going to take time with their current hedges, and their declines in production over the past year.

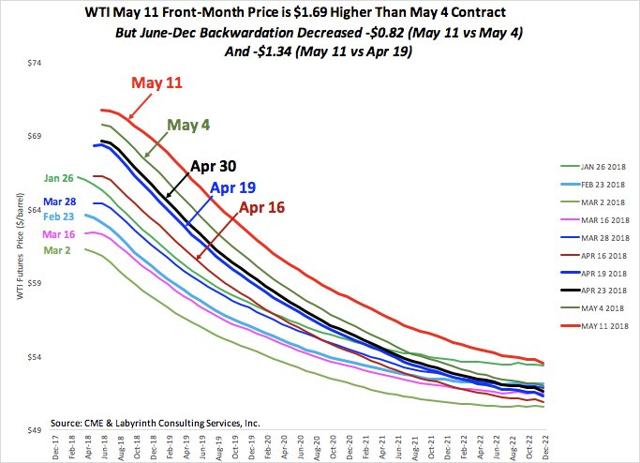

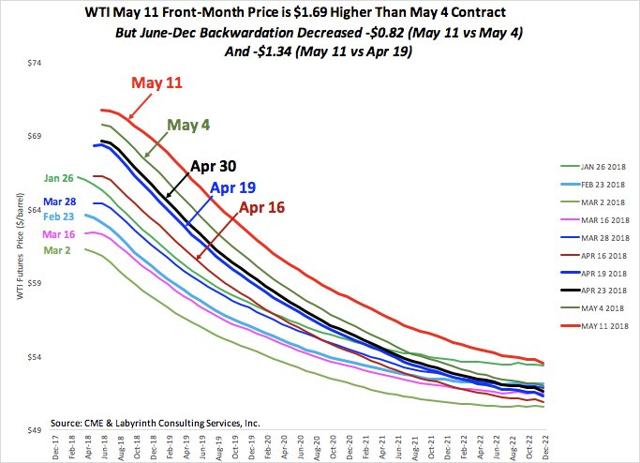

Specific to the proposed ARO deal, I have a mixed opinion. On one hand, I can understand that it was negotiated during a time of lower oil prices. Thus, I am in agreement with you, that if oil prices were in the $50s, or even low $60s, I would applaud the deal, for the reasons you mentioned, including cleaning up the nearest-term AROs, and priming the runway for funding for drilling, which is desperately needed to increase production. On the other hand, oil prices are improving by the day, with signs of upward movement in longer-term prices. Building on this narrative, backwardation has actually narrowed over the past week, even with increasing prices at the front end, and the belly of the oil futures prices curve is starting to widen, which should be very bullish for EGC, and other downtrodden E&P producers, who have been waiting for higher future prices.

(Source: Art Berman)

All things being equal, if I owned the entire firm, I would rather let the undervalued asset appreciate, hedge where applicable to fund drilling in stages, and accelerate drilling if the futures curve cooperates. This scenario provides the most upside potential, however, it carries the highest risk. Thus, I think management has taken a middle of the road approach, de-risking, while securing funding for drilling.

You also asked, "do we really have the potential to not approve it down the road and if so what optionality does that imply?"

From my past experience, I have to think that EGC shopped the deal around to Oaktree (OAK), and others, and initially these firms passed on committing capital, thus leading us to the arms of ONR & Tom Clarke. However, now, with the recent movement in oil prices, perhaps Oaktree comes back to the table, not wanting to be diluted and superseded by another large shareholder, who is looking to capitalize on the opportunity. This last point is entirely speculation as I do not have direct knowledge of discussion. Having said this, the recent increase in oil prices, particularly if the oil futures curve continues its shift higher, is going to potentially throw a monkey wrench in this deal. What I mean is that normally I think this deal would go through nine times out of 10, or even a higher percentage, but now, I'm now so sure, and this uncertainty is going to cap EGC's share price in a sense, however, it also provides some upside optionality if a better deal comes along from another interested party.

EGC reminds me of a different firm in a different industry, and that firm is Genworth Financial ( GNW) which has an open deal right now to be acquired by China Oceanwide for $5.43 in cash (GNW shares closed today at $3.17). I followed GNW for a long time, personally buying shares in late 2008 and early 2009 for below $1 per share, and then selling these shares for 7x gains in 2009, not capturing all of the upside, but doing pretty well. I continued following this firm, and we bought shares in The Contrarian's Best Ideas Model Porfolio on 2/9/2016 for $1.75 per share, and then selling them on 6/28/2017 for $3.72 per share, for a gain of 113%. Today, there could be another opportunity, as the underlying business has improved, IMO, and shares are still trading well below the cash buyout offer of $5.43. Full disclosure, we own no position today.

(Source: WTK, StockCharts)

You may ask, why am I comparing GNW to EGC?

Well, the answer is, that the energy sector went through a horrific bear market, which, somewhat unbelievably, just ended for many energy equities, even though oil has been rising for over two years now. This bear market in energy equities, which occurred in stages from 2014-2018, depending on the particular energy equity, was every bit as brutal as the 2007-2009 declines in the broader stock market. (Building on this narrative, the decimation in the energy sector from 2014-2018 was very reminiscent of the decimation in financial equities from 2007-2009.)

For my members, I have used another analogy of homebuilders, which bottomed in 2009, but then made a secondary bottom in 2011. Long story short, the energy equity bear market has been brutal, and the resulting opportunity, if oil prices, natural gas liquids prices, and natural gas prices continue to cooperate, will be every bit as big for the surviving energy equities as it was for the beaten down equities like GNW in 2008/2009. Continuing the analogy, EGC has a tremendous amount of share price appreciation potential, almost a kinetic energy right now, yet in the long run, it could have similar path to GNW, so the initial surge higher could mark the recovery highs for a long time.

Looking back, I sold my initial GNW shares too early, even though I had tremendous gains. After that, GNW became a trading stock, which is what almost every stock is, IMO. On this note, the real long-term wealth is in buy-and-hold investments, but I think in the energy sector, it is very difficult to find these long-term investments, so really, these stocks are swing trades, not buy-and-hold forever equities. Specific to EGC I think that is going to be the challenge for EGC shareholders, in the months ahead, again assuming energy prices cooperate, knowing when to sell, as I think at some point, we will either reach a short-term peak, or EGC will be sold to another entity.

That is speculation for the future.

For now, I have two more questions for you. First, the more I look at EGC's financials, and past financials, ARO is already accounted for in their EBITDA, so it should not be a double hit to their EV/EBITDA calculations. Do you agree on this point?

Second, would an ideal outcome, the key word being "ideal" for EGC shareholders, simply be a slow ramp up from cash flows from drilling, with some selected hedging, till they are eventually able to self fund? We know the ideal outcome is not going to happen, but what would you do if you owned the whole company? How would you maximize value? And wrapping this series of questions up, what is the most likely outcome, given everyone's incentives, in your opinion?

Darren:

Thanks for that backwardation graph, I was looking for a source for that literally an hour ago. The GNW analogy and discussion helped put things in perspective also. I would note a nice thing about backwardation is it tends to be correlated with low and declining storage as well as price increases. Thus, while the backwardation may very well be a reason why EGC hasn't hedged more than it has yet, it is all good so far.

Anyway, the curve still looks pretty steep to me. It may have flattened a bit, but it's not terribly noticeable yet. Not enough for me to conclude it is flattening. As for your other questions:

1.) First, the more I look at EGC's financials, and past financials, ARO is already accounted for in their EBITDA, so it should not be a double hit to their EV/EBITDA calculations. Do you agree on this point?

Yes, but I sometimes include ARO in EV anyway just to get rid of whole, "but ARO is debt" objection. If I'm going to add ARO into EV, I should then also be pulling the ARO cost out of EBITDA, EBITDAARO? :), but I must confess I've been too lazy to do that. Sometimes you do something incorrect just because it forestalls an objection and the result is going to lead to the same decision anyway. I used to use straight EV/EBITDA but got tired of the "you��re not including ARO!" back and forth.

2.) Second, would an ideal outcome, the key word being "ideal," for EGC shareholders, simply be a slow ramp up from cash flows from drilling, with some selected hedging, till they are eventually able to self-fund?

Yes, assuming oil prices continue to rise.

3.) We know the ideal outcome is not going to happen, but what would you do if you owned the whole company? How would you maximize value?

If I were CFO, I would recommend hedging the heck out of LLS at whatever price I'd calculated pays for drilling the moment a future reached that price (I and another member of CFK jointly calculated this was probably around $67 per barrel). While this doesn't necessarily maximize value, particularly if oil goes to $100 over the next year like I think it might, but I'd do it anyway because I think it has the best risk / reward tradeoff for me personally.

The reason I would do this is because I don't know oil is going to $100, I just think it is. What I do know is funding drilling is my main problem and a lot of issues, including ARO, ultimately get solved by increasing drilling. I also know my current given alternative to fund drilling is 35% dilution. 35% dilution is permanent and therefore does a lot more harm to long-term value than hedging a year and a half��s production at $67 does (currently LLS can be hedged at $67 through July 2019). People will complain about that too, but ultimately you are trying to bridge to the point where production pays for drilling plus a profit. Why create a long-term solution (35% hedging) to what at its nature is a bridging problem if you don't have to?

That being said, I have to caveat that just a few months ago I would have jumped all over this deal. So, my intention is not to be critical of management here. I just think the price of oil changed and now we have better options open to us which retain more upside. Honestly, even if the deal went through as is, I'd just shrug and adjust my thinking to 90% of the new 2P value, it��s still a really nice gain.

4.) And wrapping this series of questions up, what is the most likely outcome, given everyone's incentives, in your opinion?

I'm glad you asked this question. Bear with me as I digress a bit, but it��s very pertinent to my answer. I have a basic belief that people do what they think is best for themselves most of the time. You do it, I do it, management will do it; maybe Saints don't, but I don't expect management to achieve Sainthood nor that a Saint would make a very good CEO. Anyway, this is a fundamental belief which has stood me well in life and I believe so true, that I need to follow where it leads (even when it leads places I don't like or agree with). So, in this case you have to put yourself in the place of management. What are they likely to think is best for themselves?

Well if I were management I would absolutely want to increase share value, because I have shares and options which I want to increase the value of. Heck, I probably got involved in what I knew would be a difficult, frustrating, and time-consuming situation(s) in part due to the potential of this carrot. However, at the same time, I as management have not just this carrot but a little thing called my paycheck to consider, and I feel like I've already put a thousand hours into the existing deal. So, I'd kind of like to keep my job and salary and maybe play with the kids every once in a while, too. These alternative incentives encourage me to take a satisfactory deal even if it is only "good" for the share price instead of optimal (hint management will frequently use the term "stakeholder" whenever they are about to do something that isn't necessarily in shareholders�� best interests).

That being said, I expect Oaktree and other similar major shareholders will hire ISS or Glass Lewis to make a recommendation. If they make us privy to it that will also be an important recommendation to consider. Ultimately, Oaktree is going to probably have the biggest say. That may mean pushing back, it may mean taking the deal and moving forward. Again, realize the person making that decision at Oaktree is probably an employee with a bonus who recommended the purchase of EGC in the first place, not necessarily a direct owner of the shares. Additionally, Oaktree owns shares because it bought the bonds in bankruptcy and is probably looking at something like a $4.50 average cost. So, given there's usually time pressures to cash out and move on, $18 in the next 12 months vs. $30 in 24 months, might look a bit different for them than it does for you and I. Overall, I take comfort from the fact that Oaktree and the like are going to be both knowledgeable and pretty well aligned with my interests. Ultimately, knowing what I know now, and not having heard back from my sources yet, when it comes time to vote I will probably:

Vote no at $75 oil and above Vote yes at $60 oil and below In between it could go either way

I'd also add I'm not sure that's not exactly what management might not prefer we do (though they can't necessarily say it publicly). If this really is an option with no breakup fee, it��s a pretty sweet deal. Additionally, I'd like to point out what we are probably really talking about here is whether EGC is ultimately targeted at 3x or 5x current price per share (given $70 oil). Frankly, I'd be happy with either.

I think this has been a fruitful discussion. Thanks for reaching out and responding. We can still carry on, but I think it might be useful to post this for my Cash Flow Kingdom members. Would you be OK with it if I started doing that?

William:

Darren,

Yes, thank you for taking the time for the exchange.

Go ahead and post for CFK. I will do the same, either tomorrow or Wednesday, depending on work schedule. Maybe a week from now, we can clean this up, and publish publicly, with both of us listed as authors. Let me know if you want to go that direction? I think there is a genuine opportunity here to have a nice capital gain.

Once we find out which way Oaktree is leaning, that will provide more context.

Darren's Follow-Up Note

William,

I heard back from my sources. Apparently, investment banks will only allow hedging of 75% of known production with that being reduced to 55% for Gulf offshore producers during the July �� October hurricane season. Unfortunately, this ends up changing the picture quite a bit. It��s very limiting given that the current production already is partially hedged and abnormally low due to lack of prior year drilling. Again, the chicken and egg problem. Can��t drill because we don��t have the funding, can��t fund because we don��t have the production from drilling. Thus, my original suggestion to hedge 100% of production at $67+ in order to bridge the cash need isn��t going to work.

Additionally, management didn��t talk about it in the conference call, but I��ve now had a chance to look at the cash flow statement. I see they have a little over three quarters of burn left. Thus, were the next hole drilled to be dry, we would suddenly be in a world of hurt. It��s still the same bridging problem, but a riskier one than I first imagined. I��ll probably vote however ISS recommends and/or Oaktree votes, but I��ll no longer be surprised if that recommendation is to take some version of the deal. We are probably talking more than a 3 bagger from here with the deal maybe taking the risk for a potential 4 bagger instead just isn��t worth it?

William��s Closing Note:

Energy XXI Gulf Coast has been on my radar for over a year, ever since they exited their prior restructuring. Darren has been covering the company through the restructuring process. As the price of oil has continued to rise, and Energy XXI Gulf Coast shares have continued to drop, it has become a interesting, potentially compelling opportunity.

(Source: WTK, StockCharts)

We initially took a position in EGC shares in The Contrarian��s Best Ideas Model Portfolio (a Portfolio that returned 126.4% in 2016, and lost -0.9% in 2017) early in the month of May, 2018, and our fair value target for the equity of Energy XXI Gulf Coast, given prevailing oil prices, is much higher than EGC��s share price currently.

After delving deeper and deeper into EGC over the past month, including a weekend where I looked at all the financial filings over the past five years, I believe that Energy XXI Gulf Coast has gotten trapped in a downward spiral, swamped by the asset retirement obligations that get more onerous with lower production. The other side of the coin is that this downward death spiral can be turned into a virtuous cycle with higher production and higher oil prices.

Tracking back to the asset retirement obligations, which is the key overhang holding back EGC shares today, in my opinion, the PV-10 values, which Darren showed in the article above, already account for the ARO, and I think EGC shares get unfairly dinged by the analyst community since ARO expenses are calculated as part of the EV/EBITDA calculations, yet almost all of these analysts then lump in ARO as additional long-term debt, which is a double penalty.

Bottom line, with oil prices significantly above the last PV-10 valuations (Darren��s table earlier in the article) there is significant appreciation potential if EGC can execute operationally.

Darren and I hope that this has been a beneficial exchange for investors in Energy XXI Gulf Coast, and we encourage any questions, comments, or feedback to be posted in the discussion thread below.

If you liked this article, please be sure to ��Follow�� Darren, and myself, for future public research. Thank you for your time, and readership.

Darren��s marketing: FREE two-week trial to Cash Flow Kingdom PLUS $100 off the first years annual membership!

For the first time ever, we are offering the public a FREE two-week trial to check out Cash Flow Kingdom, and $100 of the first year of your annual membership when you decide to stick around after that free trial period. We've never made offer to the public before and may never do so again. So, if you would like to find out more about the equities listed above, or what other investments are on the Income List, now is the time. Ask yourself, what do you have to lose?

William��s marketing

William's marketing: Rare two-week free trial currently open to The Contrarian

Recently we published a 55-page deep dive research article on one of our most compelling long ideas, and to celebrate, we are extending the window for our two-week free trial to The Contrarian. With a two-and-a-half year track record of Model Portfolio��s that have generally significantly outperformed the markets, and their targeted benchmarks, The Contrarian offers a rare window into what we think are some of the best value investments in the stock market today.

Disclosure: I am/we are long EGC, AROC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: This article discusses a speculative investment. I do not know your goals, risk tolerance, or particular situation; therefore, I cannot recommend any investment to you. Please do your own additional due diligence. Additional disclosure: Every investor's situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Kura Oncology (NASDAQ:KURA) was the target of unusually large options trading on Thursday. Stock investors bought 699 put options on the company. This represents an increase of 694% compared to the typical daily volume of 88 put options.

Kura Oncology (NASDAQ:KURA) was the target of unusually large options trading on Thursday. Stock investors bought 699 put options on the company. This represents an increase of 694% compared to the typical daily volume of 88 put options.

What do you think William? Is the ARO deal a good one? Do we really have the potential to not approve it down the road and if so what optionality does that imply? What about EGC as general investment either with or without the deal?

What do you think William? Is the ARO deal a good one? Do we really have the potential to not approve it down the road and if so what optionality does that imply? What about EGC as general investment either with or without the deal?

KBC Group NV boosted its position in Medtronic PLC (NYSE:MDT) by 2.4% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 655,442 shares of the medical technology company’s stock after purchasing an additional 15,628 shares during the period. KBC Group NV’s holdings in Medtronic were worth $52,580,000 at the end of the most recent quarter.

KBC Group NV boosted its position in Medtronic PLC (NYSE:MDT) by 2.4% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 655,442 shares of the medical technology company’s stock after purchasing an additional 15,628 shares during the period. KBC Group NV’s holdings in Medtronic were worth $52,580,000 at the end of the most recent quarter.